Model Governance and Model Risk Management: Risk Manager’s Perspective

Aug 16, 2014

460 likes | 955 Views

Model Governance and Model Risk Management: Risk Manager’s Perspective. Nikolai Kukharkin Quantitative Risk Control, UBS Measuring and Controlling Model Risk, New York, October 2011. DISCLAIMER

Share Presentation

- simplified description

- potential action plan items

- risk manager

- organizational changes

- effective model validation

- overall valuation risk

Presentation Transcript

Model Governance and Model Risk Management: Risk Manager’s Perspective Nikolai Kukharkin Quantitative Risk Control, UBS Measuring and Controlling Model Risk, New York, October 2011 DISCLAIMER The views and opinions expressed in this presentation are those of the author and may not reflect the views and opinions of UBS and should not be cited as being those of UBS.

What Can Go Wrong With Models? • More extensive policies, stricter regulations, and more comprehensive model risk management programs.

Kill All the Quants?... * • Risky Business on Wall Street: High-tech supernerds are playing dangerous games with your money TIME magazine, April 11, 1994 • Recipe for Disaster: The Formula That Killed Wall Street Wired Magazine, Feb 23, 2009 • The Minds Behind the Meltdown: How a swashbuckling breed of mathematicians and computer scientists nearly destroyed Wall Street WSJ, Jan 22, 2010 • Financial Crisis Can Be Traced to “the Quants” The Kansas City Star, Feb 22, 2010 *) Andrew W. Lo, “Kill All the Quants?: Models vs. Mania in the Current Financial Crisis”, 2009.

…Before They Are Born… Too large a proportion of recent "mathematical“ economics are mere concoctions, as imprecise as the initial assumptions they rest on, which allow the author to lose sight of the complexities and interdependencies of the real world in a maze of pretentious and unhelpful symbols. John Maynard Keynes, The General Theory of Employment, Interest and Money, 1935

…Or May Be Not? Myron Scholes, Risk Magazine, September 2011 • It should be a golden age for risk modeling and management • “One thing about a crisis is that it shakes old opinions and you start learning new things. I hope we do – I am very bullish on the future for quants.” • He warns against overreliance on models, and concedes they had a role in the crisis. But the common-sense reaction – embracing intuition, and rejecting the use of modeling and quantitative techniques – is also flawed, he argues… • Presumably you used your intuition in picking the model, and intuition can fail, too.

New FED/OCC Supervisory Guidance on Model Risk Management • Expands on existing regulatory guidance by broadening the scope beyond model validation to include all aspects of model risk management at all stages: model development, implementation, and use • Revises and expands model and model risk definition • Establishes comprehensive model risk management program requirements • More formalized and expanded model governance and controls • Increased standing of model risk management function: needs to be influential; have explicit authority to challenge model developers and users • Model validation • Introduces “effective challenge” standard • Key elements of comprehensive validation : • Evaluation of conceptual soundness • On-going monitoring • Outcomes analysis

Comprehensive Model Risk Management Program Requirements • The bar has been raised significantly with respect to the scope, formality, rigor, and prominence expected of banks’ model risk management programs. • “Model risk should be managed like other types of risk.” • Life-cycle view of model risk - model risk management framework is expected to include standards for model development, use, and maintenance to which all model owners, users, and other stakeholders will be held. • Broader roles and responsibilities – it is not just the responsibility of the model validation unit: model developers / owners, users, validators, senior management, internal audit • Model risk management is an on-going, continuous, process – not a periodic activity: • Monitoring model risks and limitations identified during development and validation • Monitoring and on-going validation of changes (i.e., products, exposures, activities, clients, or market conditions) that may impact model risks • Regular model performance monitoring (i.e., back-testing, benchmarking, sensitivity analysis, and stress testing) • Model risk reporting to senior management and the board of directors.

How Should Banks Respond? • Examiners expect a bank to perform a self-assessment against new regulatory guidance, and have a clear action plan for closing identified gaps. • Potential action plan items may include the following: • Revisions to policies and procedures • Revisions to roles and responsibilities • Organizational changes • Development of new standards and guidelines for model development, implementation, and use • Revised model inventories (including an inventory of model-specific risks and limitations) • Mappings of model risk mitigation controls against existing inventory of model risks and limitations • Creation / enhancement of on-going model monitoring processes • Creation / enhancement of model risk reporting • Additional model validation testing (e.g., vendor models) • Creation of annual model review process

Model Validation: What’s Next? • Financial industry obtains a significant share of revenue from products valued by mathematical models • Models are here to stay and reliance on them will only grow • Consequently, model risk is a topic of great, and growing, interest in the risk management arena • How to define it • How to measure it • How to manage it • Qualitatively reasonably well defined • Much less successfully quantified and even less successfully managed • What is expected from model validators and how is the role changing? • What are the key priorities for model validators?

Model Risk: Define and Manage A model can be defined as: A simplified description or representation of an entity or process, property, characteristic or behavior which cannot be represented or predicted with complete certainty.The output of a model is therefore an estimate or approximation. 1. Model risk is the potential for adverse consequences from decisions based on incorrect or misused model outputs and reports. 2. Model risk is the risk of error due to a deficiency in design or implementation of a pricing model. In other words, model risk is the risk of occurrence of a significant difference between the mark-to-model value of a product and its fair value. Or more flexible definition by R. Rebonato 3. Model Risk is the risk of occurrence of a significant difference between the mark-to-model value of a complex and/or illiquid instrument, and the price at which the same instrument is revealed to have traded in the market. Note that neither “true” nor “fair” value is mentioned, i.e. ->>> Market is the king More sophisticated / realistic / correct model is not necessarily the best

Model Governance Process • Regulators on Model Risk: FSA “Model Risk contributes to overall valuation risk. Model validation and model risk management processes are important elements of any valuation control framework. Whilst effective model validation is fundamental, model validation, however good, does not remove model risk. Few firms have sufficiently well developed frameworks for articulating model risk tolerance, and measuring and controlling model risks within that tolerance. We believe a better defined and implemented model risk management framework could therefore feed into a better defined and implemented valuation risk-management framework.” - from FSA’s “Dear CEO” letter on Valuation and Product Control principles, August 2008 • Regulators on Model Risk: FED and OCC Supervisory Guidance on Model Risk Management, April 2011 Model risk should be managed like other types of risk. Banks should identify the sources of risk and assess the magnitude. Model risk increases with greater model complexity, higher uncertainty about inputs and assumptions, broader use, and larger potential impact. …With an understanding of the source and magnitude of model risk in place, the next step is to manage it properly.

Model Risk Management Framework Goal is to set up a framework to explicitly, fully, and dynamically account for model risk • Partially accounted for by: • Qualitative capture • Models certification • Periodic model risk review • Quantitative capture • Model reserves • Sensitivity analysis • Portfolio reviews

Model Risk Management Framework Governance: Independent Verification Unit (IVU) with the mandate for: - independent review and certification of valuation models - independent risk-based review of model-related risks, i.e., the risk that the model either through a deficiency in design or implementation produces faulty output. The aim of the certification process is to obtain the required level of comfort that the model in question is functioning in an accurate and appropriate way. Model performance monitoring process: - Full review of potential model risks and existing control processes across systems and product areas taking into account factors including materiality, model choice, model applicability - This is independent from running certification processes, it challenges existing model issues and includes actions that are or should be taken Frequency and depth of reviews: Regulators requested model verification updates of the “high-risk” to be done more frequently, annually, compared to previous 5-y cycle for all certifications.

Model Governance Process – High-Risk Models Definition of High-Risk Models Define dimensions and criteria to categorize models as “high risk” Definition is altered based on new information / past actions Capture of High-Risk Models Agree on review types Run / participate in the reviews throughout the year Review Filter all models according to preliminary criteria Working Groups of IVU product specialists adjust filtered product list and define necessary actions Actions based on Reviews Consolidate results of reviews already undertaken Take further actions if necessary

Definition - Model Risk Types The following major model risks types were defined 1. Model inconsistencies or approximations Inconsistencies in mathematical assumptions of the model or its implementation Model assumed fit for purpose, although does not fully capture some features The model may be used outside of its range of applicability 2. Model choice Model choice uncertainty - several models are available (and one is being used) Many solutions could satisfy the same constraints 3. Calibration, model parameters, and input data issues Multiple sets of parameters can satisfy market; multiple sets of calibration instruments available, sometimes model cannot fit all of them simultaneously; uncertainty in model input parameters 4. Controls (booking approximations + level of oversight) The control environment into which the model is being released. Level of oversight by other control groups and therefore the probability of an error being detected 5. Complexity Exotic features, number of inputs, and the importance of inter-relationships between them models assumptions/conditions 6. Model/Product maturity and level of standardization Maturity, liquidity and rate of change of the market

Capture – Model Risk Scores Model risk scoring process Start with the certified product list and link and rank it according to the risk scores in several dimensions as well as materiality of positions: • Each product is described in terms of “High=3”, “Medium=2” or “Low=1” Risk Scores for each of the following six risk factors (combined Risk Score is between 6 and 18): 1. Model inconsistencies or approximations 2. Model Choice 3. Calibration, model parameters, and input data issues 4. Controls (booking approximations + level of oversight) 5. Complexity (exotic features, number of inputs, models assumptions/conditions) 6. Model/product maturity and level of standardization • Capability to compare model risk between models / products across all areas • This list is used as a starting point to identify models/products which will be subject to the annual review • Additional win – not just a formal more frequent re-certification, but rather a review targeting specific features which make this product/model high-risk

Is Theoretical Value Fair? • Most of the issues listed in the previous section can also give rise to model fair value adjustments Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (FAS 157) • Accounting standards demand that if the value of asset or liability is not directly observable but rather obtained from a model (“marked-to-model"), it needs to be further adjusted to bring it into closer alignment with the market fair value. Why is such adjustment needed? • Model can have a known bias/deficiency • There can be an uncertainty around the model generated value due to: • existence of the alternative models (i.e., no industry standard) • non-uniqueness of calibration • uncertainty around (unobservable) model inputs • Terms “Model Fair Value adjustments” and “Model reserves” are often used interchangeably, but they mean different things and should not be mixed up

What Do Accounting Standards Say About Model Reserves? They say… NOTHING Model reserves may serve as a proxy, intuitive way to account for perceived model risk Model FV adjustments aim at “fine-tuning” model generated number to bring it into a better alignment with the market price. FV adjustments make the “best educated guess” of where the market is Model risk attempts to assess the tails of the theoretical price distribution, expresses how far off our “best guess” might be from the realized price • Model risk arises from the uncertainty in model specification, be it the model parameters and/or inputs (i.e., function arguments), or the model (function) itself. When not observable, FV of an asset is a variable characterized by some probability distribution. While model FV adjustments attempt to pinpoint the center of such distribution, its higher moments are the domain of model risk. • NOTE: Frequent practice of using “parameter uncertainty” and sometimes “alternative model” reserves to create a “conservative cushion” roughly the size of perceived model risk, contradicts the accounting standards which concentrate on fair value.

Inherent Model Risk • Valuation uncertainty beyond model FV adjustments is the domain of (inherent) model risk • Can be viewed as “residual” model risk. With proper model validation in place, inherent model risk can be minimized but never eliminated • Needs to be measured, monitored, and managed • Deserves a place in overall risk management framework on a par with market and credit risk • Should be considered alongside the market and credit risks in allocating capital, making business decisions, and managing the trading positions

Final Observations • There is always a risk that a model can be “wrong” • In part model risk is a variety of operational risk, i.e. the possibility of a human error • However, there is also an inherent uncertainty due to the very nature of financial modeling • The purpose of model governance is to set up policies and procedures that: • 1) minimize operational risk - Achieved through model validation, periodic reviews, model change management, back-testing, etc. • 2) provide for measurement, monitoring, and management of inherent model risk (model uncertainty) - Requires recognition of model uncertainty’s role alongside market and credit risk, and devising and implementing methods, processes and systems for measuring capturing reporting and managing model risk • Therefore, model risk deserves a place alongside market and credit risk in making business decisions (e.g., in capital allocation) as well as in the risk management and reporting process.

- More by User

Risk-Based Audit

Risk-Based Audit. Audit Risk Assessment Model. (Excel model included in last slide). Audit Risk Model. AUDIT RISK MODEL Purpose to prioritize audit schedule for creation of audit plan. All risks are relative but can be compared by combining three key factors with equal overall weighting :

1.96k views • 31 slides

Risk Management

Risk Management. Risk Definitions. Risk Management The practice of dealing with project risk. It includes planning for risk, assessing risk, developing risk response strategies, and monitoring risk throughout the project life cycle. 35. Risk Definitions. Risk

1.28k views • 55 slides

Risk Management and Internal Controls

Risk Management and Internal Controls. ASSAL 20 November 2014. Annick Teubner Chair, IAIS Governance Working Group. Agenda. Introduction Risk Management and Controls Why Risk governance and controls matter… Revision ICPs ’: topics 2014

447 views • 23 slides

Acct 351 Class Presentation

Li Yuen Yung Wong Wai Kit Wong Yik Yin. Acct 351 Class Presentation . Agenda. Audit Risk Model Reasons for high audit risk in China Inherent Risk (IR) Control Risk (CR) Detection Risk (DR) Conclusion Recommendation . Audit Risk Model. Audit Risk Model. IR. CR. DR.

567 views • 27 slides

Risk Management. Objectives. Define risk management, risk identification, and risk control Understand how risk is identified and assessed Assess risk based on probability of occurrence and impact on an organization. Introduction.

757 views • 32 slides

Assessing Model Risk in Practice

Assessing Model Risk in Practice. Model Risk in Credit Scoring, Imperial College 28 th September 2012. Alan Forrest. RBS Group Risk Analytics Independent Model Validation. Vfinal 260912. Assessing Model Risk in Practice. Disclaimer. Disclaimer

439 views • 15 slides

Risk management - law and governance: Bridging the gap between action and (legal) actions.

Risk management - law and governance: Bridging the gap between action and (legal) actions. Dr Michael Eburn. “The Risk Society”. Beck , Ulrich (1992), Risk Society; towards a new modernity ( Sage, London). Sees everything in terms of risk.

304 views • 12 slides

What can Risk Management do for You

What can Risk Management do for You. November 2 , 2012 By Department of Public Safety and Security Risk Management & Insurance Department Keith A Goodenough , Risk Manager www.uidaho.edu/risk. Identify exposures relevant to all U of I operations .

232 views • 6 slides

Risk Management Industry update

www.pwc.com. Risk Management Industry update. IASA April 2014. John Campbell. Agenda. Introduction Risk Management ORSA Model Risk Management Risk Appetite. Risk Management ORSA update. The Own Risk & Solvency Assessment.

870 views • 30 slides

PRMIA Toronto Chapter Event The ALPHA and BETA of Corporate Governance and Risk Oversight

PRMIA Toronto Chapter Event The ALPHA and BETA of Corporate Governance and Risk Oversight. Tuesday, March 8, 2011 Alex Todd TE Research A division of Trust Enablement Inc . Understanding Systemic Risk. Risk Management & Systemic Risk. Risk Management in a Complex World. Risk Management.

652 views • 44 slides

RISK MANAGEMENT SYSTEM

RISK MANAGEMENT SYSTEM. ISTANBUL, OCTOBER 2011. CALIBRI BOLD 42 pt. AGENDA . RISK MANAGEMENT IN BRIEF FUNCTION ORGANIZATION RESPONSIBILITIES ACTIVITIES REPORTS WORKS Risk Management Policies CREDIT RISK MARKET RISK OPERATIONAL RISK. RISK MANAGEMENT SYSTEM. RISK MANAGEMENT IN BRIEF.

1.03k views • 23 slides

Risk Minds USA 2013

Risk Minds USA 2013. Risk Governance and Risk Management: Oxymorons ? J. V. Rizzi June, 2013 Macrostrategies , LLC. Table of Contents. Introduction Decisions Governance Why Change Conclusion. Introduction. Introduction. Risk governance worked, except for “rare” exceptions…

409 views • 24 slides

FIN 685: Risk Management

FIN 685: Risk Management. Topic 3: Non-Linear Hedging Larry Schrenk, Instructor. Topics. Black- Scholes Model Greeks Hedging An Extended Example. The Black- Scholes Model. Black- Scholes Formula. Variables. S = Spot Price X = Exercise Price r = Risk Free Rate

515 views • 41 slides

CAS-5 FATIGUE MODEL FOR AVIATION FRMS

Circadian Alertness Simulator™ CAS-5 Modeling of Aircrew Fatigue Risk Dr. Martin Moore-Ede FRMS Forum, Montreal - September 2, 2011. CAS-5 FATIGUE MODEL FOR AVIATION FRMS. A scientifically-validated fatigue risk model is a vital tool in aviation Fatigue Risk Management Systems (FRMS).

1.15k views • 63 slides

Enterprise Governance, Risk and Compliance Management Pharma Colloquium

Enterprise Governance, Risk and Compliance Management Pharma Colloquium Princeton University June 6, 2005 . PwC. Agenda. PwC Global CEO Survey on Governance, Risk and Compliance Regulatory Expectations COSO Enterprise Risk Management Open Compliance and Ethics Guidelines.

604 views • 27 slides

The Department of Energy Enterprise Risk Management Model

The Department of Energy Enterprise Risk Management Model. Using the Risk Assessment Tool to Prepare a Justification Memorandum for the Development and Revision of Departmental Directives. Enterprise Risk Management (ERM) Model - Background.

416 views • 10 slides

How Wrong is your Model? Efficient Quantification of Model Risk

How Wrong is your Model? Efficient Quantification of Model Risk. Advanced Statistical Methods in Credit Risk Royal Statistical Society Alan Forrest, RBS Group London, 13th June 2013. Information Classification – PUBLIC. Disclaimer. Thanks

408 views • 23 slides

RISK MANAGEMENT MODULE A – Asset Liability Management AND MODULE B – Risk Management

RISK MANAGEMENT MODULE A – Asset Liability Management AND MODULE B – Risk Management. A PRESENTATION BY K ESWAR MBA XLRI, CAIIB CHIEF MANAGER, SPBT COLLEGE. BANKS TYPICALLY FACE THREE KINDS OF RISK. Type of Risk. Example.

1.06k views • 75 slides

Balancing Throughput and Security Risk in a Border Management System

Balancing Throughput and Security Risk in a Border Management System. Bojan Cukic Lane Department of CSEE West Virginia University Dagstuhl Seminar 10431. UML Model with performance annotations. Performance Model. Risk Model. Application’s Performance/risk feedback. Framework.

223 views • 10 slides

Be - Collaborative Risk Management

Be - Collaborative Risk Management. Collaboration, Risk and Reward in Other Industries Michael Mainelli, Executive Chairman. Agenda. Governance and the risk society Mutuals et al Enterprise risk/reward management systems Challenges for Property organisations Information sharing.

523 views • 23 slides

Solvency II workshop Governance, Risk Management and Use

Solvency II workshop Governance, Risk Management and Use. 9 & 10 September. Agenda. Introduction Model Change Themes from submissions Feedback from recent reviews Evidence Templates Planned Use Test Review Activity in Q4 Table discussions Minimum Standards update

508 views • 39 slides

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser.

Newly Launched - AI Presentation Maker

AI PPT Maker

Powerpoint Templates

PPT Bundles

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

- Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Top 10 Risk Management Model PowerPoint Presentation Templates in 2024

Our Risk Management Model PowerPoint template is a versatile tool designed to assist professionals in effectively analyzing, assessing, and mitigating risks within their organization. The template includes a comprehensive set of editable slides that cover various aspects of risk management, such as risk identification, assessment, prioritization, response planning, and monitoring. With visually appealing graphics, charts, and diagrams, users can easily communicate complex risk management concepts to stakeholders and team members. This template can be used in a wide range of industries and scenarios, including project management, financial planning, compliance, and strategic decision-making. Whether you are a risk manager, project manager, or executive, this template will help you streamline your risk management processes and enhance decision-making to ensure the success and sustainability of your organization.

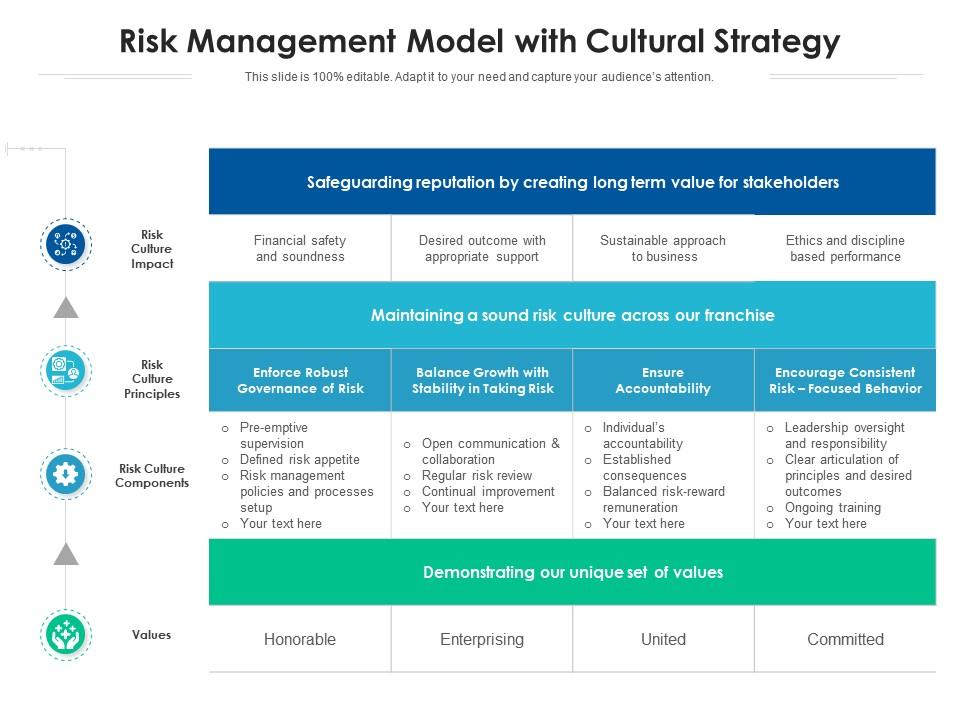

Risk management model with cultural strategy

Introducing our Risk Management Model With Cultural Strategy. set of slides. The topics discussed in these slides are risk culture impact, risk culture principles, risk culture components. This is an immediately available PowerPoint presentation that can be conveniently customized. Download it and convince your audience.

Our Risk Management Model With Cultural Strategy are topically designed to provide an attractive backdrop to any subject. Use them to look like a presentation pro.

- Risk Culture Impact

- Risk Culture Principles

- Risk Culture Components

Related Products

Risk Management Plan In Business Powerpoint Presentation Slides

The PowerPoint presentation supports easy way to add, edit and compile data. Helpful to management professionals, big or small organizations and business start ups. Text and graphic can arranged to complement each other in all the PPT slides. Ensures recasting the color, size and orientation in presentation slide show as per business need. High quality resolution in color and graphics is supported by PPT graphic. Each slide offers good resolution without disturbing the pixels quality in PPT layout when viewed on widescreen. Flexible in approach with Google slides.

There might be inherent risk that cannot be avoided and thus a Risk Management Plan in Business PowerPoint Presentation Slides becomes lifeline in such cases. The data compiled and saved in PPT layout not only helps to minimize or eliminate the risk associated but also helps to deal with it effectively at the time of its occurrence. To foresee any risk, a risk assessment matrix is a must and the same is supplied from our end in a structured and professional manner in the presentation template. Line and flow charts in PPT template acts as the oxygen to eliminate risks like strategic, compliance, financial, operational and reputational hazards. The core risk management steps have been addressed carefully in the presentation slide which includes identification, analyzing, evaluation, ranking, monitoring and reviewing of the same. As far as business risk is concerned, a lot of factors come to play like sales volume, input cost and much more, thus every slide in PPT presentation pays special attention to the same. Our Risk Management Plan In Business Powerpoint Presentation Slides ensure thoughts appear extremely balanced. You will display great composure.

- Risk Management Plan In Business

- Risk Management Strategy In Business

- Risk Management Approach In Business

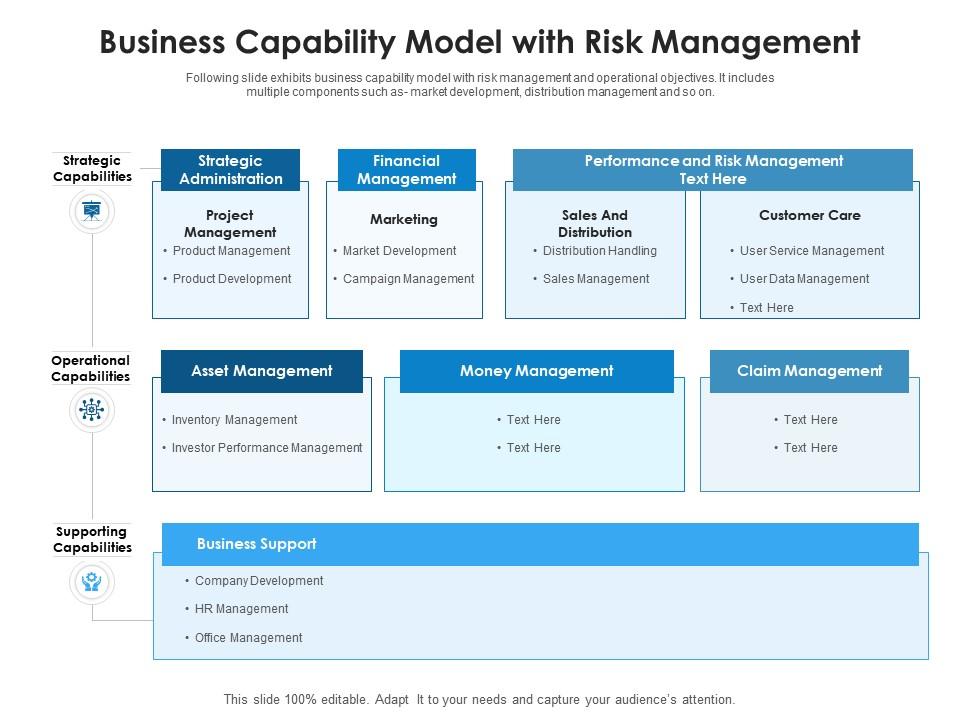

Business capability model with risk management

Following slide exhibits business capability model with risk management and operational objectives. It includes multiple components such as market development, distribution management and so on. Presenting our well-structured Business Capability Model With Risk Management. The topics discussed in this slide are Strategic Capabilities, Operational Capabilities, Supporting Capabilities. This is an instantly available PowerPoint presentation that can be edited conveniently. Download it right away and captivate your audience.

Following slide exhibits business capability model with risk management and operational objectives. It includes multiple components such as market development, distribution management and so on.

- Strategic Capabilities

- Operational Capabilities

- Supporting Capabilities

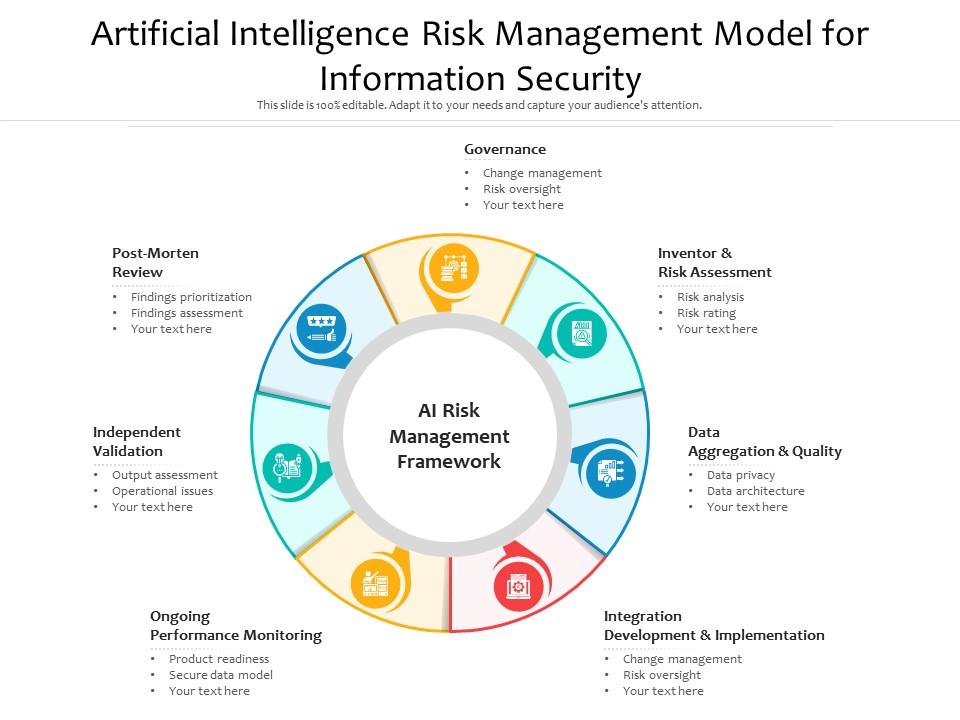

Artificial intelligence risk management model for information security

Presenting our set of slides with name Artificial Intelligence Risk Management Model For Information Security. This exhibits information on seven stages of the process. This is an easy to edit and innovatively designed PowerPoint template. So download immediately and highlight information on Artificial Intelligence, Risk Management, Model Information, Security.

Our Artificial Intelligence Risk Management Model For Information Security are topically designed to provide an attractive backdrop to any subject. Use them to look like a presentation pro.

- risk management

- Model Information

Manage model risk ppt powerpoint presentation infographics grid cpb

Presenting this set of slides with name Manage Model Risk Ppt Powerpoint Presentation Infographics Grid Cpb. This is an editable Powerpoint four stages graphic that deals with topics like Manage Model Risk to help convey your message better graphically. This product is a premium product available for immediate download and is 100 percent editable in Powerpoint. Download this now and use it in your presentations to impress your audience.

Our Manage Model Risk Ppt Powerpoint Presentation Infographics Grid Cpb are explicit and effective. They combine clarity and concise expression.

- Manage Model Risk

Manage model risk ppt powerpoint presentation visual aids gallery cpb

Presenting our Manage Model Risk Ppt Powerpoint Presentation Visual Aids Gallery Cpb PowerPoint template design. This PowerPoint slide showcases four stages. It is useful to share insightful information on Manage Model Risk This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

Our Manage Model Risk Ppt Powerpoint Presentation Visual Aids Gallery Cpb are topically designed to provide an attractive backdrop to any subject. Use them to look like a presentation pro.

Security breach risk management model

This slide exhibits data breach risk management model. It includes major evaluation criteria such as- does the management has two unique credentials to perform administer activities, does the multifactor authentication is enabled for administrative access etc. Introducing our Security Breach Risk Management Model set of slides. The topics discussed in these slides are Asset, Control Topic, Evaluation Questions, Response, Threat. This is an immediately available PowerPoint presentation that can be conveniently customized. Download it and convince your audience.

This slide exhibits data breach risk management model. It includes major evaluation criteria such as- does the management has two unique credentials to perform administer activities, does the multifactor authentication is enabled for administrative access etc.

- Control Topic

- Evaluation Questions

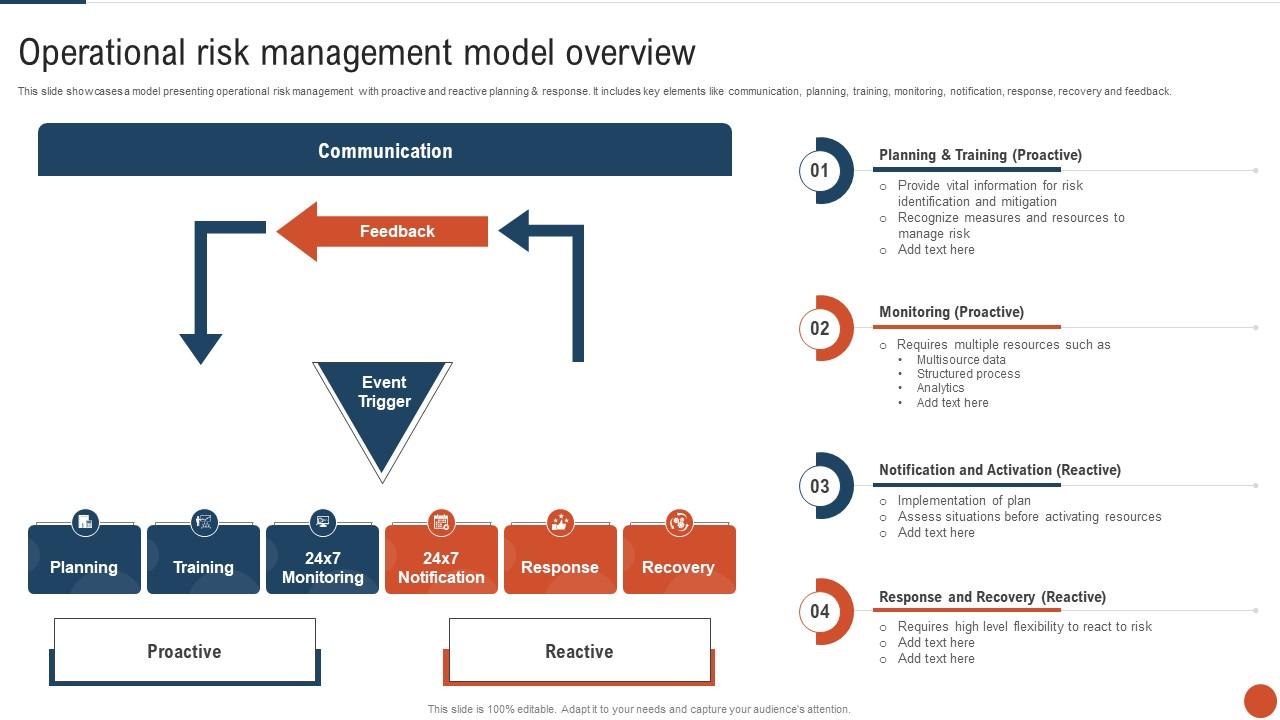

Operational Risk Management Model Overview

This slide showcases a model presenting operational risk management with proactive and reactive planning and response. It includes key elements like communication, planning, training, monitoring, notification, response, recovery and feedback. Presenting our well structured Operational Risk Management Model Overview. The topics discussed in this slide are Monitoring, Notification And Activation, Response And Recovery. This is an instantly available PowerPoint presentation that can be edited conveniently. Download it right away and captivate your audience.

This slide showcases a model presenting operational risk management with proactive and reactive planning and response. It includes key elements like communication, planning, training, monitoring, notification, response, recovery and feedback.

- Notification And Activation

- Response And Recovery

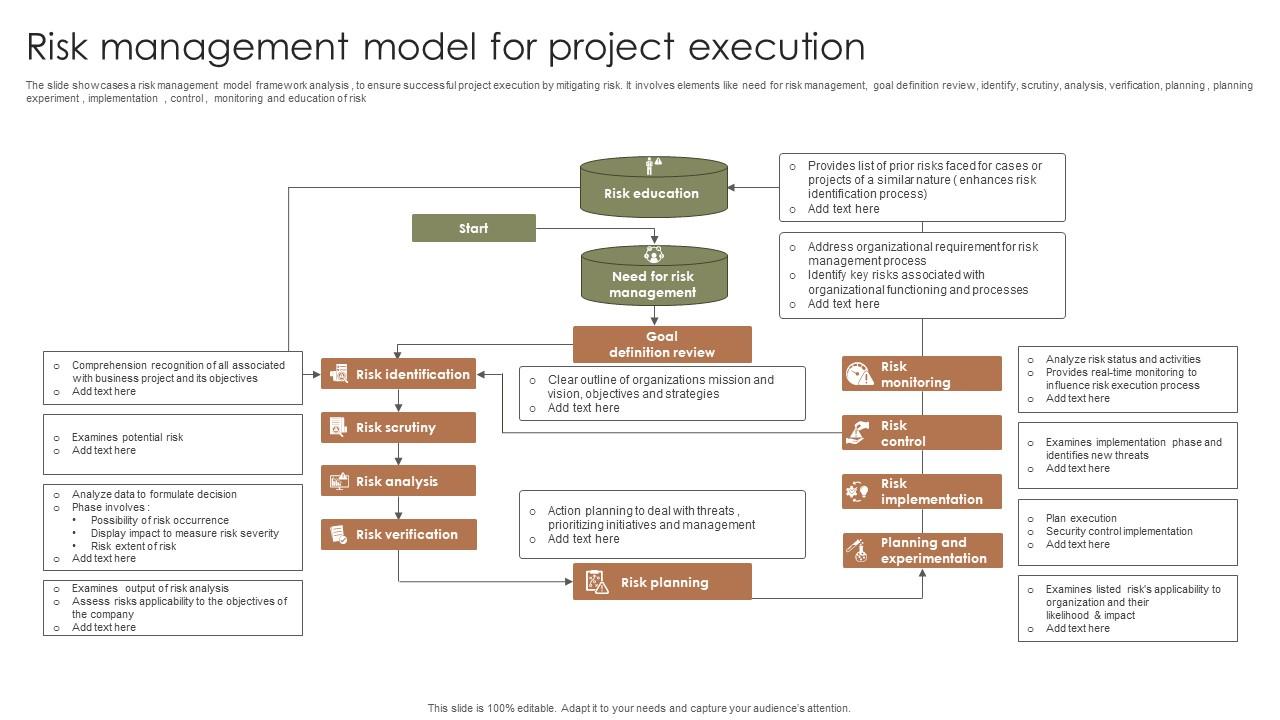

Risk Management Model For Project Execution

The slide showcases a risk management model framework analysis, to ensure successful project execution by mitigating risk. It involves elements like need for risk management, goal definition review, identify, scrutiny, analysis, verification, planning, planning experiment, implementation, control, monitoring and education of risk. Presenting our well structured Risk Management Model For Project Execution. The topics discussed in this slide are Risk Identification, Risk Scrutiny, Risk Analysis. This is an instantly available PowerPoint presentation that can be edited conveniently. Download it right away and captivate your audience.

The slide showcases a risk management model framework analysis, to ensure successful project execution by mitigating risk. It involves elements like need for risk management, goal definition review, identify, scrutiny, analysis, verification, planning, planning experiment, implementation, control, monitoring and education of risk.

- Risk identification

- Risk Scrutiny

- Risk Analysis

Operations procurement risk management models risk management reports cpb

Presenting this set of slides with name - Operations Procurement Risk Management Models Risk Management Reports Cpb. This is an editable three stages graphic that deals with topics like Operations Procurement, Risk Management Models, Risk Management Reports to help convey your message better graphically. This product is a premium product available for immediate download, and is 100 percent editable in Powerpoint. Download this now and use it in your presentations to impress your audience.

Innovate to create with our Operations Procurement Risk Management Models Risk Management Reports Cpb. Come up with a design that blows the imagination.

- Operations Procurement

- Risk Management Models

- Risk Management Reports

IMAGES

VIDEO

COMMENTS

This slide should be your Presentation Title Slide, the first slide of your presentation. It should also be the last slide of your presentation. ... Framework based on Model Risk Management Guidance OCC Bulletin 2011-12 /Federal Reserve SR Letter 11-7. Includes key elements of 2000-16. Expanded from "Validation" to "Model Risk Management"

MODEL RISK MANAGEMENT Presentation by Federal Reserve and OCC FRB Richmond/Charlotte MRM Forum. September 2016. Background/Context 2 Agencies now have a half- decade of experience in evaluating MRM frameworks that are based on the 2011 model risk management guidance (MRMG) ...

Top 10 Model Risk Management PowerPoint Presentation Templates in 2024. Model Risk Management (MRM) is a crucial aspect of financial institutions and organizations that rely on quantitative models to inform their decision-making processes. It involves the identification, assessment, and mitigation of risks associated with the use of models ...

This is a enterprise risk management analysis ppt model. This is a four stage process. The stages in this process are life insurance and risk management activities, input and risk identification, policy development, risk, based monitoring, financial reporting, contract and acquisition, operational. ...

About the speakers Aika Msuya IAA DNA NFF Actuary and a Financial risk management professional with 15 years cross-over background within banking and insurance industry. Specialized in model risk management; model risk oversight / validation of internal/regulatory capital risk models. Also, a consultant in delivering wide range of actuarial services and Pension fund Lead Actuary.

Managing Artificial Intelligence (AI) Risk. February 2021. Jacob Kosoff. Head of Model Risk Management. The opinions expressed in this presentation are statements of the presenter's opinion, are intended only for informational pu rposes, and are not formal opinions of, nor

Director, Model Risk Management SAS Institute, North Carolina, USA Best Practices in Model Risk Management. MEETING REGULATORY GUIDELINES GLOBALLY AND LOCALLY ... * Source: Bank Risk Conference presentation in April 2015 by Konstantina Armata (Head of Global Model Validation & Governance at Deutsche Bank) = Process area. Process Design

5 Model Risk Management 21 6 Capital Management 22 6.1 Economic Capital 24 6.2 Internal Stress Testing 25 7 Risk Based Pricing 28 8 Recovery Planning 30 9 Resolution Planning 31 10 Bank Risk and Finance on Quality Data 32 11 Artificial Intelligence 19.2 for Financial Institutions 35 B CREDIT RISK MANAGEMENT 12 Credit Risk Management Framework ...

Model Governance and Model Risk Management: Risk Manager's Perspective Nikolai Kukharkin Quantitative Risk Control, UBS Measuring and Controlling Model Risk, New York, October 2011 DISCLAIMER The views and opinions expressed in this presentation are those of the author and may not reflect the views and opinions of UBS and should not be cited as being those of UBS.

Top 10 Risk Management Model PowerPoint Presentation Templates in 2024. Our Risk Management Model PowerPoint template is a versatile tool designed to assist professionals in effectively analyzing, assessing, and mitigating risks within their organization. The template includes a comprehensive set of editable slides that cover various aspects of ...